Nsw Supreme Court Probate Scale Of Costs

Http Www Trusts It Admincp Uploadedpdf 201009131810580 Tantau 20v 20macfarlane 20 2010 20nswsc 20224 20 25 20march 202010 Pdf

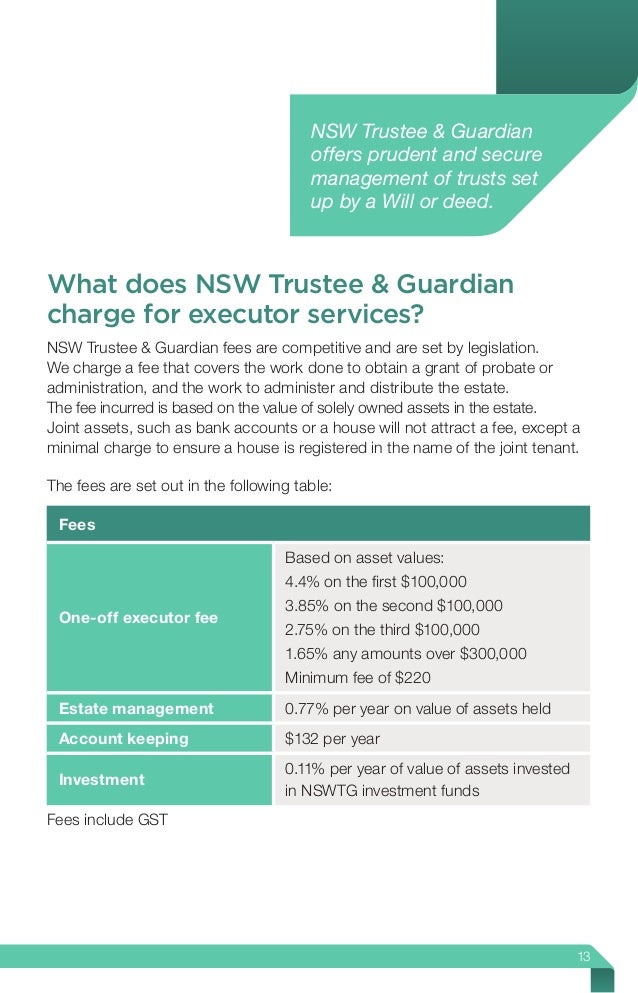

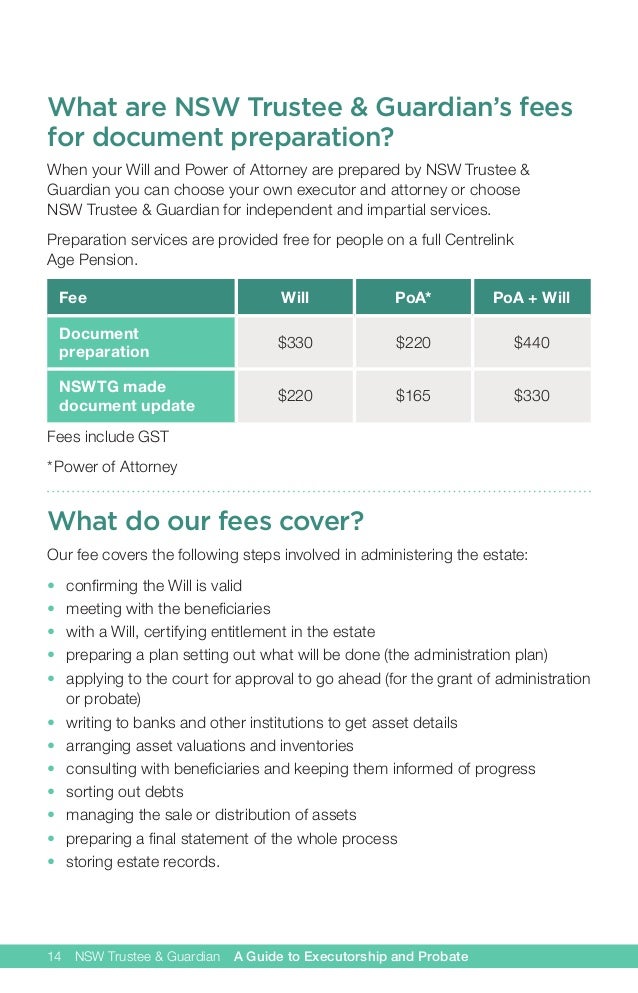

Schedule 3 legal profession uniform law application regulation 2015 gross value of estate assets professional costs fixed by regulation costs range excl.

Nsw supreme court probate scale of costs. 1670 plus 447 for each 1000 in excess of 150000. A certified copy of a will or a grant of probate costs 145. The courts processing times for probate applications are as follows.

Up to 20 working days from date of filing. Gst 0 to 29999 560 plus 1333 for each 1000 up to 30000 560 to 960 30000 to 149999. Contesting a probate application costs 1143 for an individual and 3128 for a corporation.

Plus 1333 for each 1000 up to 30000. Disclosed value of assets. Exceeding 150000 but not exceeding 1000000.

Probate 100000 or more but less than 250000. 175th anniversary of the supreme court of nsw. July 2019 probate letters of administration scale costs nsw supreme court the costs of applying for probate or letters of administration in nsw are regulated by the nsw legal profession regulation and the nsw supreme court as follows.

This sets a scale of fixed costs for the various stages of probate depending on the value of assets remaining at the time of the application. The filing fee is payable to the supreme court upon filing of the application for a grant. Can i pay a fee by telephone.

This is what most other firms charge. Not exceeding 30000. Fees calculated on the gross value of the nsw assets only probate less than 100000 000.

50th anniversary of the nsw court of appeal. 100000 or more but less than 250000. Filing fees and other charges set by the court generally increase every july so current charges may increase in july 2020.

Civil procedure amendment fees regulation 2020 nsw. The amount of the filing fee corresponds to the gross value of the nsw estate. Payments by cheque or money order should be drawn in favour of the supreme court of nsw.

100000 or more but less than 250000. Sentencing symposiums 2014. Value of estate assets.

If you have been issued with an invoice for a supreme court fee you can pay by credit card over the phone by calling 1300 679 272. Exceeding 30000 but not exceeding 150000. 250000 or more but less than 500000.

960 plus 590 for each 1000 in excess of 30000. Depositing a will with the court for safe keeping costs 134. This is the nsw regulation scale of fees.

We do not always charge at this scale. 560 plus 1333 for each 1000 up to 30000. We offer discounted probate rates usually well below this scale.

The following are the filing fees for the respective estates as of the 20202021 tax year. Exceeding 1000000 but not exceeding 3000000. Gross value of nsw estate.

Http Www Lec Justice Nsw Gov Au Documents Online 20registry 20resources Online 20registry 20user 20guide 201 34 Pdf